The hypothetical production data is for a profit maximizing firm, providing a unique opportunity to explore the principles and applications of profit maximization in a simulated business environment. This data-driven analysis will delve into the key variables, marginal analysis, production function, market structure, and competition, offering valuable insights into the complexities of profit-driven decision-making.

By examining the relationships between input costs, output levels, and revenue, we will uncover the optimal production strategies that maximize profits for a firm operating in a competitive market.

Profit Maximization Principles

Profit maximization is a fundamental goal for firms operating in a market economy. It refers to the process by which firms seek to maximize the difference between their total revenue and total costs, thereby maximizing their profits.

The profit maximization principle is based on the assumption that firms are rational actors that seek to maximize their economic well-being. To achieve profit maximization, firms must meet certain conditions:

- Perfect knowledge of market conditions, including demand and cost functions

- Ability to adjust production levels and prices to optimize profit

- Absence of external constraints, such as government regulations or labor unions

Firms can achieve profit maximization by:

- Increasing output to the point where marginal revenue equals marginal cost

- Optimizing their product mix and pricing strategy

- Controlling costs and minimizing inefficiencies

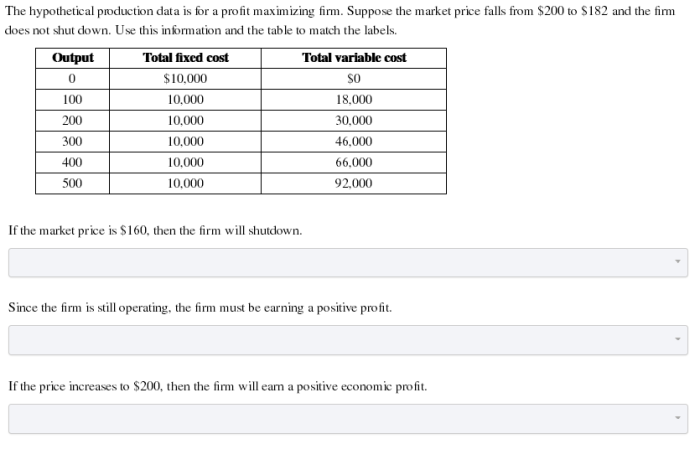

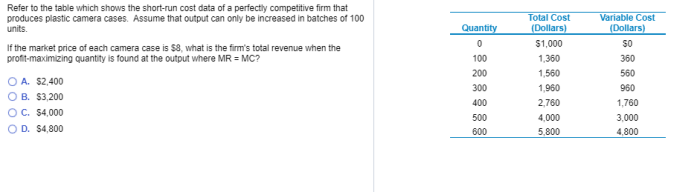

Hypothetical Production Data Analysis

The hypothetical production data provided includes information on the relationship between output level and total costs and revenue. The key variables in this data are:

- Output level (Q)

- Total revenue (TR)

- Total cost (TC)

- Marginal revenue (MR)

- Marginal cost (MC)

The relationship between these variables can be analyzed to determine the profit-maximizing output level. This level is where the difference between TR and TC is maximized, or where MR = MC.

Marginal Analysis

Marginal analysis is a technique used to evaluate the impact of changes in output on profit. Marginal revenue is the change in total revenue resulting from a one-unit increase in output, while marginal cost is the change in total cost resulting from a one-unit increase in output.

By comparing MR and MC, firms can determine the output level at which profit is maximized. This is the point where MR = MC, as at this level, the additional revenue generated by producing one more unit is equal to the additional cost incurred.

Production Function and Cost Structure

The production function describes the relationship between inputs (e.g., labor, capital) and output. The cost structure refers to the breakdown of costs into fixed costs (e.g., rent, equipment) and variable costs (e.g., raw materials, labor wages).

The production function and cost structure affect profit maximization by determining the level of output that can be produced at a given cost. A more efficient production function or lower fixed costs can lead to higher profit levels.

Market Structure and Competition

The market structure in which a firm operates can significantly impact its ability to maximize profits. Perfect competition, where there are many buyers and sellers, and firms have no market power, leads to a highly competitive environment with low profit margins.

In contrast, a monopoly, where there is only one seller, allows the firm to exercise market power and set prices above marginal cost, leading to higher profit margins. Other market structures, such as oligopoly or monopolistic competition, offer varying degrees of competition and profit potential.

FAQs: The Hypothetical Production Data Is For A Profit Maximizing Firm

What is the purpose of profit maximization?

Profit maximization aims to determine the optimal output level at which a firm generates the highest possible profit, considering revenue and cost factors.

How does marginal analysis contribute to profit maximization?

Marginal analysis compares marginal revenue and marginal cost to identify the output level where additional production generates the greatest incremental profit.

What is the impact of market structure on profit maximization?

Market structure influences the degree of competition and pricing power, which in turn affects a firm’s ability to maximize profits.